They come to a land down under

Visitor numbers have been looking perkier recently, and not just for the reason you’d expect.

Since New Zealand began to reopen its international border in early 2022, the recovery in overseas visitor numbers has been mixed. The overall numbers have been improving compared to their pre-Covid levels, but there’s still some way to go – the early predictions that a full recovery was more of a 2024 story look to have been broadly on the mark. And the experience has varied across source markets: arrivals from Australia rebounded quickly, while the US and Europe have been a little slower and Asia in particular has been sluggish.

There were plenty of reasons to expect this to be the case. First there’s the Covid factor – either fear of the virus itself, or perhaps New Zealand’s lingering reputation for tough restrictions (no-one wants to be caught in another lockdown in a foreign country). Then there’s cost: flights are a lot more expensive than they were before Covid, and there are fewer seats available. And finally, it takes a while for people to make new travel plans – not so big a deal for a short hop across the ditch, but more so for those in the Northern Hemisphere who would be looking for a longer stay. All of those barriers should fade with the passage of time.

More recently we’ve also had the temporary boost from the FIFA Women’s World Cup. Prior estimates had been for an additional 20,000 to 25,000 overseas visitors for the tournament, roughly a 10% uplift on what we normally see at this time of the year.

So what’s the verdict on how we’re currently performing? As is often the case with economic data, we face a trade-off between timeliness and accuracy. The most commonly quoted figures are reported on a monthly basis, but they come with a sizeable lag – the latest release is for June, which pre-dates the World Cup. However, Stats NZ also provides a selection of data on a weekly and even a daily basis on this page. They’re more limited in detail, but they can still give us a steer on what’s happening.

I’ll focus first on the daily figures. These are made available very quickly – the latest release goes up to 22 August, which encompasses the full period of the tournament (the last match played in New Zealand was on the 15th). However, there are a few important points to note. Firstly, these figures are for the number of border crossings – at this point the data doesn’t distinguish between short-term visitors and longer-term migrants. But normally the former vastly outweighs the latter – even with the currently elevated levels of migration, they only make up around 3% of arrivals. So for our purposes it’s reasonable to assume that all of the variation is coming from short-term visitors.

Secondly, it doesn’t give an accurate picture of where people are coming from. There’s a split between New Zealand citizens and non-New Zealand citizens (I’m focusing here on the latter). And it does identify which country that people have arrived from. But this will accord with their home country only if they took a direct flight to New Zealand (if there was one). Long-haul travellers will often need to get a connecting flight, or they’ll include a stopover, which is why these figures show disproportionately high arrivals from the likes of Fiji and Singapore, and basically no-one from Europe.

With that in mind, here’s what the total figures look like:

The numbers for this year are well up on last year, when the border was still being reopened in stages, and the gap to 2019 (the last full pre-Covid year) is narrowing. We also seem to be reverting to the same seasonal patterns as before. (Note that when comparing daily data, you may need to shift it forwards or backwards by a week to account for the timing of school holidays.)

You can also see something of a bump from mid-July, when people would have started to arrive for the World Cup. Prior to that, arrivals were running at a little more than 80% of pre-Covid levels. If we’d maintained that ratio, we would have seen about 230,000 arrivals during the tournament period; the actual figures were almost 250,000. That suggests a little under 20,000 additional visitors associated with the World Cup. That’s probably an understatement, since there may have also been some displacement – some people who were planning to come to New Zealand anyway may have shifted their bookings to either side of the tournament, to avoid the busy period. But as an early rough cut, this suggests that the forecasts for the tournament were broadly on the mark.

We can test that further by looking at the breakdown of who has been coming into the country. Next we turn to the weekly data, which does separate out short-term visitors and identifies their home countries. However, there’s much more of a delay on this – the latest release is for the week ending 30 July, so there are only two weeks of data so far that encompass the tournament.

Here the impact of the tournament is clear: visitor arrivals were up by about 13,000 on the previous two weeks, with the majority of the lift coming from the US as expected. There was also, to a lesser degree, a rise in visitors from the UK, Europe and Japan. (Australians seem to have stayed at home, where all of the Matildas’ matches were.)

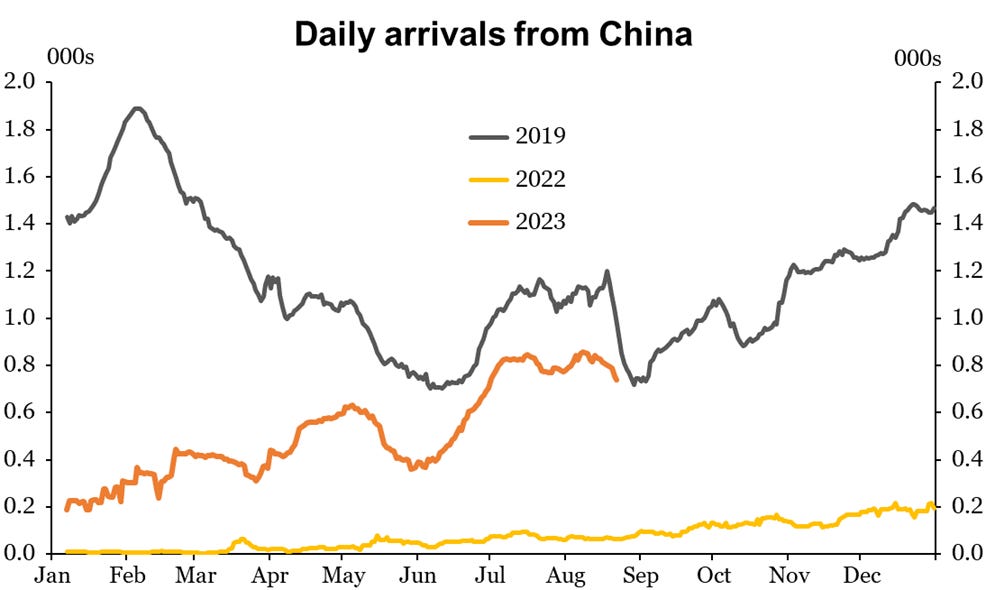

The weekly figures also reveal something that had escaped my attention until now: visitor numbers from China are now on a solid upward path. Not surprisingly, the Chinese travel market has been the slowest to revive, due to the government’s continued pursuit of a zero-Covid policy until it was dramatically dropped at the end of 2022. In the first months of 2023, visitor numbers were still only running at around 10% of pre-Covid levels. But things have improved since then.

Unfortunately I don’t have the weekly visitor numbers for 2019, but if we turn back to the daily data (bearing in mind the issues mentioned earlier; we’re looking at the trend rather than the absolute numbers), the gap to pre-Covid levels has narrowed further since June.

That hints at an underlying change in attitudes going on. Even once Covid restrictions had been removed in China, the initial hopes for a rebound in overseas travel weren’t high. A survey of potential travellers in January found that around 40% had no plans to travel overseas this year; by April that proportion had fallen to a still-high 31%. Among the reasons for not intending to go overseas, concerns about Covid remained high, albeit easing (and it doesn’t seem to have put them off from travelling within China). Concerns about their own financial situation were also high on the list, and many noted difficulties in getting travel visas and the high cost of flights and accommodation.

Nothing has happened to soften these attitudes other than the passage of time. To me that suggests that the recent strength is not just a temporary wave of pent-up demand, but a more enduring recovery that has further to run. It may not look like it for the next couple of months, but don’t be fooled by seasonality – July-August numbers normally run a bit hotter than Sep-Oct. The summer period will be much more telling.